Nestled at the foot of the Bighorn Mountains, Sheridan, Wyoming, is the sort of place where an out-of-towner can pick up a pair of cowboy boots to sport at a nearby rodeo. But a new commodity has been rivaling the popularity of the area’s Western wear: cheap company incorporations — with no travel necessary for far-flung customers.

In the spring of 2020, in an attempt to avert an economic collapse amid COVID-19 shutdowns, the U.S. government began dispensing billions of dollars in emergency loans to American businesses to maintain their payrolls. Among the millions that received the Paycheck Protection Program funds was a Wyoming-registered firm called the Alo Group, which received $531,562 to support the wages of 36 U.S.-based employees the firm said it had, according to public records.

But it’s unclear whether the Alo Group was a legitimate business. The firm has no public profile, and on a state corporate filing it listed a disposable email address — [email protected] — at a domain name that has been used by scammers, according to the fraud detection firm IPQS. After it received the large COVID relief payment, the Alo Group switched its listed mailing address to a building in China, according to corporate records, before dissolving completely for failing to file required state paperwork.

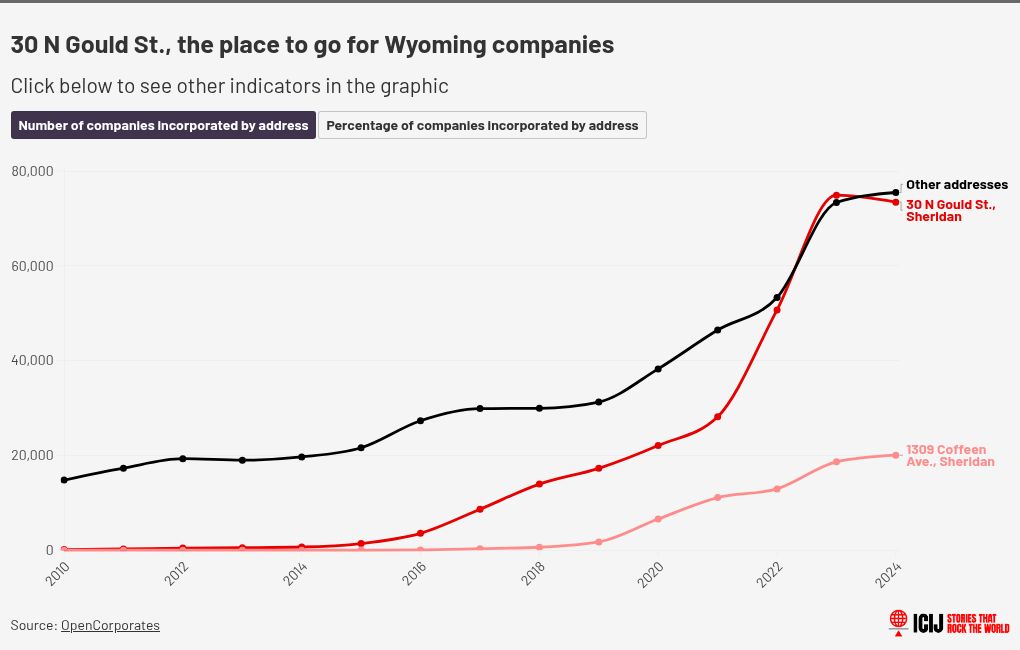

The Alo Group traces its origin to a single-story storefront in Sheridan that is a hotspot in the state’s thriving corporate formation industry. The small building is home to the Sheridan office of Registered Agents Inc., a national corporate services firm; more than 266,000 companies incorporated using the address of this modest office between 2019 and 2024, according to an International Consortium of Investigative Journalists analysis of information provided by the data firm OpenCorporates.

Firms like Registered Agents file official paperwork on behalf of businesses and, in doing so, can be used to help mask the true owners.

Companies registered at the Sheridan storefront are listed in a half-dozen criminal indictments of people across the country who allegedly stole millions in COVID relief payments from the federal government, according to an ICIJ analysis. Hundreds more companies that together received tens of millions of dollars in Paycheck Protection Program (PPP) loans share the same Sheridan address: 30 N. Gould St. Some of these appear to be legitimate firms, but dozens, like the Alo Group, have little trace of aboveboard business.

Registered Agents told ICIJ that it works closely with law enforcement and does not have extensive ties to the firms it helps administer. “Our address and business name appear as a registered agent on thousands of business entity records with the Wyoming Secretary of State, which has been misconstrued as us having a controlling interest in, or extensive relationship with, those entities,” Dan Mahoney, a spokesperson for the company, said in an emailed statement. “This is simply not the case.”

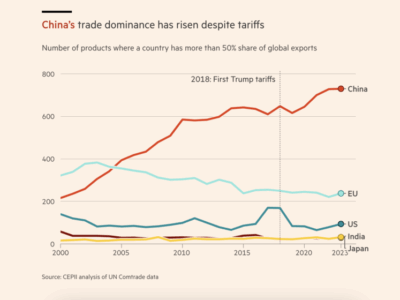

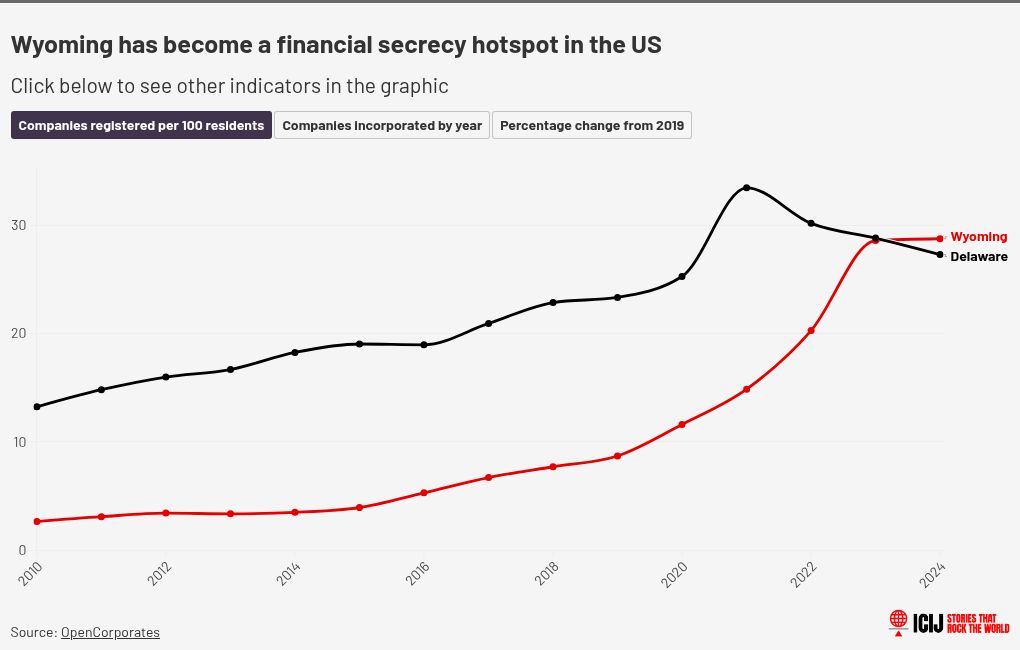

The fraud indictments add to growing evidence that Wyoming is a major new destination for people outside the state — including criminals, suspected North Korean sanctions evaders, and those with wealth of dubious origin — to incorporate secretive limited liability companies, or LLCs, and other entities to hold and move cash. In December, ICIJ reporting showed that the state had overtaken Delaware in its rising per capita number of incorporations, leaving officials in the least populated U.S. state grappling with how to oversee a proliferation of anonymous shell companies.

Tara Berg, the county assessor for Wyoming’s Fremont County, told ICIJ that over the past several years residents have begun complaining about shell companies that, in an apparent attempt to appear legitimate, have falsely used the residents’ home addresses on corporate filings. “We have people bringing us stacks of mail that they’re getting for these companies at their addresses,” Berg said. “People are panicked.”

A small storefront with big questions

Wyoming is similar to most states in that its laws allow individuals to form shell companies with no requirement to disclose the true owners to government authorities or anyone else. But in recent years the state’s corporate services industry has promoted itself as offering a particularly potent mix of legal features that can pile extra layers of secrecy onto anonymous entities. This includes its booming business of unregulated trusts that can interlock with anonymous LLCs registered in the state to create a secretive structure that wealth managers call the “cowboy cocktail.” These layers of corporate secrecy can help shield a person’s assets from creditors, tax authorities and former spouses seeking assets during divorce proceedings.

As part of its 2021 Pandora Papers investigation, ICIJ and The Washington Post revealed that more than a dozen ultrawealthy foreigners had selected Wyoming to establish this trust structure. Among them were a Russian billionaire and an associate of a Dominican dictator, according to ICIJ’s findings. A 2021 promotional document from a Cyprus-based corporate services firm highlighted that Wyoming was “overtaking the Cayman Islands, Singapore and New Zealand” as the preferred location for forming LLCs and trusts. Wyoming “is not a target of the Inland Revenue Services to discover unreported taxes,” the document stated, appearing to refer to the name used by several national tax authorities around the globe.

Registered Agents provides corporate formation services across the U.S. and, according to a 2024 report in Wired magazine relying on the accounts of several former employees, the firm maintained a practice of listing fictional names of people on corporate filings. The Wired story said that six allegedly fake names were listed as officers for 887 of businesses registered to the Sheridan office at 30 N. Gould St. Last year, companies registered at the address were linked to a suspected North Korean money-laundering network and a separate cyber sabotage campaign targeting journalists around the world. Registered Agents said that Wired’s claims were “patently wrong” but did not comment further.

The firm told ICIJ that it offers crucial help to law enforcement. “Registered agents provide an avenue for legal notices to be served on companies that would otherwise be difficult to locate,” Mahoney said in a statement. “Registered agents also collect required contact information not currently requested on Secretary of State records, which can make it easier for law enforcement and state and federal agencies to locate business owners who might otherwise be difficult to contact.”

We are just not being proactive in protecting our citizens from the fraud that’s obviously here.

— Fremont County assessor Tara Berg

The millions in U.S. federal dollars that poured into shell companies registered at the nondescript, yellow-brick Wyoming storefront reflected a convergence of the state’s booming registration business with the federal government’s hurried and often haphazard dispensing of COVID relief payments.

A 2023 report by the Government Accountability Office criticized the federal Small Business Administration, which dispensed the relief payments, for lacking sufficient controls to prevent and detect fraud. The report said that anonymous firms often abetted the fraud. Of 989 recipients of allegedly fraudulent loans from the Paycheck Protection Program and a related federal program, more than 70% were identified as shell companies or fictitious entities, the report found.

It’s easy to form these kinds of companies in Wyoming. For a small storefront, 30 N. Gould St. has accounted for a significant share of the state’s rising number of incorporations. An analysis using data from OpenCorporates shows that Registered Agents’ Sheridan address accounts for more than 40% of all new incorporations in Wyoming between 2019 and 2024.

Many people seeking to set up firms in Wyoming have little other connection to the state. This appears to be true for firms registered at 30 N. Gould St. listed in federal fraud indictments.

Such cases include that of Andrew Marnell, who pleaded guilty to bank fraud and money laundering and was sentenced in 2023 in a Los Angeles federal court for using shell companies to obtain nearly $9 million in PPP loans for hundreds of fictitious employees. Marnell spent the proceeds on, among other items, Rolex watches, a Range Rover and a Ducati motorcycle, according to federal prosecutors. One of the key firms in his scheme, Slatestone LLC, was registered at 30 N. Gould St. and received more than $1.3 million to support 75 people the firm claimed to employ, according to prosecutors.

According to a 2024 indictment and corporate records, a Florida-based man named Jared Dean Eakes established an array of shell companies — all registered at 30 N. Gould St. — that took in $4.8 million in fraudulent loans from the federal government. Eakes, a former Merrill Lynch financial adviser and broker, also allegedly used companies registered at the address to steal more than $2 million from people who transferred him funds believing he was a private wealth manager, according to the indictment. Eakes pleaded not guilty to the charges and the case is pending.

In August 2024, Andre Shammas, in San Diego, pleaded guilty to helping to set up shell companies, including one registered at 30 N. Gould St., to defraud the government’s emergency relief program and obtain more than 40 PPP loans with a total value exceeding $5 million.

Registered Agents says it’s serious about illegal conduct. “We take appropriate steps to terminate service as a commercial registered agent when necessary or required,” Mahoney said.

ICIJ analyzed the 50 companies registered at the Sheridan address that received the largest sums in PPP loans — totalling $15.5 million. For more than half of those companies, ICIJ could find little evidence of legitimate business and could not locate anyone to discuss their business. Twenty-one of those latter firms have since been dissolved by the state due to not paying taxes.

Like dozens of other firms that ICIJ analyzed, the Alo Group’s paperwork was initially filed by Registered Agents with no hint of a business purpose, a location of its activities or identification of its ownership. In its initial filing, the firm listed Riley Park as its only public representative, along with the 30 N. Gould St. address. Wired magazine later identified Park’s name as one of the allegedly fake aliases used by Registered Agents. There is no suggestion that Registered Agents’ customers were aware of any fictitious names being listed on their forms.

On April 30, 2020, the Alo Group filed its first required annual statement. The filing included a new name: “Syed B,” listed as the firm’s president. (ICIJ could not determine who this person is — or whether such a person ever existed.) A few months later, the SBA approved the Alo Group for the $531,562 loan to support its payroll of 36 employees as listed on its loan application, according to public records.

ICIJ tried several phone numbers and email addresses listed on the Alo Group’s corporate records but did not receive any response. In the 2020 filing, the firm listed a secondary address at a storefront in Niagara Falls, N.Y. Representatives for the local economic development organization and the regional chamber of commerce said they’d never heard of the firm. The county clerk’s office said it had no files relating to the firm.

In 2021, the Alo Group switched its listed mailing address to a suburb of Hangzhou, China, while keeping 30 N. Gould St. as its Wyoming registration. The Chinese street address — 969 W. Wen Yi Rd., Yuhang District — matches that of the global headquarters of ecommerce giant Alibaba, one of China’s largest private firms. In a statement to ICIJ, a spokesperson for the Alibaba Group said the company had nothing to do with the Alo Group. “There is no affiliation in any manner, and we have no knowledge regarding the company or its business interests,” the spokesperson said. The company said that no firms unrelated to Alibaba Group have a presence at its Wen Yi Road headquarters.

In February 2022, after failing to file its required annual statement, the Alo Group was dissolved administratively.

In a statement, Registered Agents told ICIJ that it has no affiliation with the Alo Group, apart from serving as its registered agent, and said it has no visibility into the Alo Group’s business activities.

Sheridan County Assessor Paul Fall said he had never heard of the Alo Group. Wyoming requires many businesses to report the value of their property within the state in order to be taxed. The masses of firms registered at 30 N. Gould St. do not appear to have generated a windfall for the county, Fall said. “We know the great majority of the companies there are not doing business here.”

Possible solutions, old challenges

Fraud in PPP loans has attracted the attention of Congress members who support President Donald Trump and Elon Musk’s aggressive cost-cutting campaign by what’s known as the Department of Government Efficiency. In a Feb. 20 letter to the head of the SBA, a group of House Republicans blasted the agency for being “unwilling and unable to recoup funds from COVID fraud.” The lawmakers indicated that DOGE would work with the SBA to address fraud in the COVID-era programs. One of those lawmakers already has introduced a bill to keep people with fraud convictions from receiving assistance from the SBA.

At the same time, Wyoming officials are looking for ways to keep fraudsters out of the state. Last year, they took a rare action against three shell companies registered at 30 N. Gould St.: The secretary of state dissolved the firms after they were named in an FBI affidavit that described a complex North Korean sanctions evasion scheme.

A Wyoming legislative committee formed to examine possible solutions has advanced several bills that would increase oversight of the state’s booming corporate registration business. These include a bill streamlining the state’s ability to dissolve companies that submitted false records to a registration agent and a separate bill to crack down on use of Wyoming shell companies. One bill that streamlines the state’s elimination of companies used by foreign adversaries was signed into law on Feb. 24, according to Wyoming Secretary of State Chuck Gray.

“Despite the opposition we’ve received from some of the registered agent community regarding our strong stance against fraud, we are going to continue to do all we can to take fraud and foreign adversaries on in Wyoming,” Gray told ICIJ in an emailed statement.

None of the bills would require firms to declare their true owners — a common impediment to law enforcement officials seeking to trace dirty money. A federal law enacted in 2021 mandates the collection of ownership information of companies across the country, but it has been bogged down by delays and legal challenges. On Sunday, the Treasury Department announced it would suspend enforcement of the requirement that U.S. companies report their ownership to the new database.

Tara Berg, the Fremont County assessor, said Wyoming should take a tougher approach toward discouraging firms from listing bogus information on corporate records.

“It’s too easy on the front end to enter false information and pay $65 — the state of Wyoming has its money and you have a corporation,” Berg said. “We are just not being proactive in protecting our citizens from the fraud that’s obviously here.”

Partially due to this ease, more than 169,000 companies were incorporated in Wyoming in 2024, three times more than five years ago, an ICIJ analysis of data provided by OpenCorporates found.

If Wyoming indeed tightens regulation of its corporate formation industry, its customers may simply go to another state with looser rules. Corporate agents in Nevada, South Dakota and Alaska have increasingly attracted far-flung clients, while lawmakers in Delaware are considering new business-friendly rules to recover business lost to Wyoming and other states. Indeed, Wyoming’s booming rate of change appears to have cooled in 2024, OpenCorporates data shows.

Gregory Coleman, an expert in white-collar crime and former FBI agent, said the ease of incorporating shell companies in Wyoming isn’t special on a national — or even global — level.

“Whether it’s Wyoming or somewhere else,” he said, “the bad guys will find the path of least resistance every time.”

Contributors: Agustin Armendariz, Jesús Escudero, Sam Ellefson