A slew of new data shows that the housing market remains largely frozen at the start of the year, posing steep challenges to President Donald Trump’s promise to thaw it.

Sales of existing homes fell 4.9% from December to January, the National Association of Realtors reported Friday, a steeper drop than expected. Though the rate improved 2% last month on an annual basis, the sales pace continues to hover around 15-year lows.

The situation isn’t much rosier for new builds: Construction permits declined 1.7% in January from 12 months earlier, while housing starts were mostly flat, federal data showed Wednesday. And homebuilders’ confidence slipped to a five-month low this month, the National Association of Home Builders’ latest survey found.

It’s been a very unusual start to 2025. A lot of buyers and sellers were thinking this was going to be their year.

Lisa Sturtevant, chief economist, Bright MLS

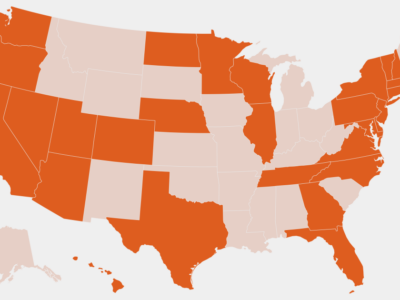

Meanwhile, homebuying remained very difficult at the end of 2024, driven by economic instability, rising costs and shortages of homes on the market, according to NBC News’ Home Buyer Index, which measures the challenges potential buyers face county by county.

The current outlook reflects the collision of long-running trends — tight, if improving, inventories; steep prices; high interest rates — with fresh uncertainties posed by Trump’s economic agenda, including tariffs and mass deportations that threaten to drive up costs.

“It’s been a very unusual start to 2025. A lot of buyers and sellers were thinking this was going to be their year,” said Lisa Sturtevant, chief economist at Bright MLS housing group.

Instead, she said, many listings are staying on the market longer as buyers wait for stubborn mortgage rates to fall.

“It’s going to be a slower spring than we hoped it would be,” Sturtevant predicted.

On the campaign trail, Trump promised mass deportations of undocumented people to free up existing properties, deregulation to spur more development and tax incentives to help first-time home buyers. He also pledged to slash mortgage rates “very fast.”

“We will drive down the rates so you will be able to pay 2% again and we will be able to finance or refinance your homes drastically at much lower costs,” Trump told Arizona rallygoers in September, estimating he would save families in the state $800 to $1,000 in monthly mortgage payments.

But nationwide, rates for 30-year fixed mortgages — the most popular type — have hovered from 6% to 8% for the last two years, and demand for mortgage applications recently fell to its lowest level in six months.